Recent Commercial Posts

Typical Water Damage Issues that can occur at Work

5/12/2022 (Permalink)

For around-the-clock emergency property assistance call on the trusted SERVPRO name with a team who cares about helping restore everything quickly.

For around-the-clock emergency property assistance call on the trusted SERVPRO name with a team who cares about helping restore everything quickly.

Water is highly valued as it is life-sustaining. Despite all its benefits, water’s impact on, around, or in a structure can be destructive when building materials and dark crevices get wet that should not be. Moisture that remains on paper, wood, or other organic materials can within hours develop mold so acting quickly when water damage is discovered is the wisest choice. Preventing water damage takes continual effort and regular maintenance but even still accidents happen. By doing what you can, the chances of avoidable circumstances are lessened. The following are scenarios to be mindful of:

Overhead sprinkler system – Intended to save both lives and properties in a fire situation, these sprinkler systems have water under pressure for when an emergency occurs. Over time pinhole leaks or a malfunction can unfortunately arise. Computers, monitors, and other electronic devices can be adversely affected if it rains indoors.

Plumbing problems – Any (even brand new) plumbing fixture, water supply line (which is constantly under pressure), pipe, or loose-fitting has the potential to leak, or sudden rupture. Indoor and outdoor drains when clogged by soil, debris, objects, hair, grease, or sanitary products can cause backups too. If the leak is inside a cabinet, under an appliance, behind furniture, under a rug, in an inconspicuous area, or located in a room or part of a room not often used, it may go unnoticed until mold becomes visible.

Surface water intrusion – Severe weather from storms, forceful winds, or exterior water pipes can lead to flash floods. Groundwater may contain harmful bacteria that if left untreated will smell positively awful in just a few hours to days.

Roof or ceiling leaks – A dripping, paint bubbling, or new water-stained ceiling are all indicators of water intrusion. Temporary tarping and roof repairs may be needed as soon as possible.

AC or HVAC condensation or leaks – Condensation is a natural occurrence and each AC unit is equipped with a drip tray. If it becomes clogged or damaged an issue can occur. Also, newly installed units can begin having issues if a mistake was made.

Clogged gutters – Even newly installed rain gutters intended to keep rain swept away can cause water intrusion. When a clog occurs from dried leaves or debris, exterior/interior walls, ceilings, and/or floors can become soaked.

Water heater leaks –Old, improperly installed, or un-maintenanced water heaters increase the odds of an eventual leak. Hot water leaks that affect building materials and are not promptly addressed can rapidly develop mold due to the warmer temperatures.

If your business experiences any of these issues a quick response will keep damages minimized. Call now for immediate assistance. 626-960-9145

What is the Cleanup Process after a Water Damage?

5/6/2022 (Permalink)

By trusting a professional restoration company for specialty cleaning needs, property owners can confidently see their business resumes ASAP.

By trusting a professional restoration company for specialty cleaning needs, property owners can confidently see their business resumes ASAP.

Water leaks can be slow or intermittent depending and many times go undiscovered until a puddle is visible or at other times moldy spots start to form…

Vs. flooding from either outdoors or indoor plumbing is typically more obvious depending on how much water is present.

Regardless of how water intrudes the premises, the important part is taking action quickly to avoid further damages. The process could be stressful and inconvenient but by hiring a professional company like SERVPRO to respond immediately to both Commercial or Residential property needs, then all imperative aspects will be properly addressed.

Our team will complementarily provide:

1st – Inspection to scope out the extent of damages, point out safety precautions and address your concerns

2nd - Recommend an IICRC protocol based on the cleanliness or bacteria content of the water

Once hired, our restoration team will:

3rd – Extract standing water from carpets and flooring

4th – Depending on the water source we will either:

a. Fully dry in place all wet materials if the water source is clean, using specialized equipment to save flooring

OR

b. Safely remove affected materials if the water source has a high bacteria content and sanitize

SERVPRO of West Covina is ready around the clock to respond to your emergency water damage needs. To get everything back to normal the right way call us ASAP at 626-960-9145

Is it Time for some Spring Cleaning at Work?

4/26/2022 (Permalink)

SERVPRO is always here to help. For any concerns or questions about unexpected property damages, call today. 626-960-9145

SERVPRO is always here to help. For any concerns or questions about unexpected property damages, call today. 626-960-9145

When spring cleaning comes to mind, we usually think it is in regards to our homes, but our office or job sites can benefit from a bit of extra attention as well. Our workplaces are our second homes because of the great amount of time we spend there each day. Our productivity and inspiration can be affected if clutter starts to visually collect around us and our allergies can act up right around springtime if dust has built up in keyboards, computers, windowsills, corners, behind furniture, and under rugs.

If you have time to set aside and allocate towards a deep cleaning endeavor, that’s wonderful but most of us have such a large workload that we can only chip away at tasks in short increments. A beneficial way to tackle these jobs is to set a 15-30 minute timer and do as much as you can during that time frame. By the end of the week, you will have completed quite a lot and will greatly benefit from your progress.

Disinfect - Since the beginning of the pandemic we all are more cognoscente of the importance of disinfecting high touch-point and common areas which is an excellent habit to maintain. Phones, keyboards, doorknobs, light switches, water cooler knobs, coffee machine buttons, etc. can all be quickly addressed with a disinfecting wipe.

Organize – A virtual cleanup of our desktop screen, organizing files, and email inbox will freshen up your visual clutter. A change of scenery by replacing your screen background is a great idea too. Dusting and then sprucing up your desk, cleaning drawers, and wiping chords and anything under the desk will help. Decluttering takes an objective eye but if you mentally prepare to toss, donate, or take home things it can make a huge difference. Minimizing personal items and things collected all year long will give you a clean slate. A clean space feels so good and the sooner you get started the more productive your workday can be.

Many times while going through the deeper cleaning process, you come across dead insects or piles of dust bunnies wrapped in hair. What a relief to get these things cleared out so you can breathe fresher air. If you discover some water staining on the ceiling, a leak under a sink, or any moldy patches, give our team a call. We can professionally evaluate the circumstance and make the needed recommendations to keep your surroundings optimal for the remaining portion of the work year.

How to get rid of mold?

4/20/2022 (Permalink)

Dealing with mold issues? Call now for a visual inspection. If you are unsure as to whether or not mold is present, call to learn about mold testing.

Dealing with mold issues? Call now for a visual inspection. If you are unsure as to whether or not mold is present, call to learn about mold testing.

With any potential property damage, prevention is key. The CDC recommends that after any sort of flooding that you clean up and dry out your home thoroughly and quickly within 24-48 hours to avoid the high risk of microbial growth.

Many have heard that you can use a bleach solution to scrub and wipe away to remove the visible mold, but will that work? It depends. If a hard surface is affected at the surface level only, is unoccupied by humans and/or pets, perhaps but PLEASE NOTE: PPE (personal protection equipment) should be used by regular building maintenance staff, and only if they have been properly trained by OSHA to do so. Also, if you are only talking about a wall or ceiling tile section where a small 10 square foot or less needs to be cleaned, the spores will become dormant and only reactivate if re-saturated.

So really depending on how much water damage occurred your plan of action may vary. Once mold starts to grow in building materials the proper IICRC protocol is to remove and replace the items. Mold spores are often likened to a dandelion. As kids, we would blow on the top cluster of the flower or lawn weed, and watch the fuzzy seeds float away and spread all over. Mold spores act very similarly and can spread quickly with air movement.

So do you hire a handyman for this job? You could but, what is their knowledge of proper removal procedures? As walls are opened, drywall, moldy carpets, or floors removed, the mold spores are kicked up into the air and could be spreading throughout the rest of your home or business if not contained.

Whether you are a homeowner, business owner, or commercial property manager/owner... Hiring an IICRC-certified professional restoration company like SERVPRO of West Covina to remediate the mold the right way using many, many years of expertise along with specialty equipment will keep the air-quality healthy which can give you peace of mind in the future.

Customer Satisfaction remains Vital in 2021

5/17/2021 (Permalink)

Happy Customers Lead to Happier Employees. Our entire team is committed to measuring customer satisfaction daily.

Happy Customers Lead to Happier Employees. Our entire team is committed to measuring customer satisfaction daily.

81 percent of satisfied customers who had a positive experience will be a repeat customer

In any industry high-standard, customer service will win return business. A loyal customer is prized so much that many professionals are willing to go the extra mile to retain clients. In the restoration industry an industrial or commercial building owner that hires us to extract flooded water throughout and dry up costly contents, may in fact never be in need of our services again unless a disaster directly affects them. However, the strong relationships that we make with local business owners and property managers mean so much to the livelihood of our business that our whole team bends over backward to make the best and lasting impression. Receiving good customer feedback is always encouraging to share with our team members as it boosts morale especially since we all work so hard to strive for excellence.

If and when our emergency property services are needed for a repeat customer, we love it when they were so happy with our hard work the first time that they call us out again. Because our main goal is to treat you the way we want to be treated, we work to gain your trust and provide a positive experience through good communication and understanding your needs and concerns throughout the whole process. A simple way to view it is that providing fantastic customer service, is a win-win for all involved. Our team will be satisfied with a job well done which makes the earning of a paycheck a bit more joyful and our clientele will appreciate having a caring professional company work at their business or home during the difficult and stressful time of dealing with unexpected damages from a fire, storm, water intrusion, mold, covid-19, or vandalism. Regardless of how we may help our SOCAL community, we are more than happy to do so. Please feel free to call today for any questions that you may have.

SOCAL Residents now have access to our 360* View & Scan Technology

5/16/2021 (Permalink)

Our new technology is ready to be put into use in your time of need. Don't go it alone when dealing with unexpected property damages. #HeretoHELP

Our new technology is ready to be put into use in your time of need. Don't go it alone when dealing with unexpected property damages. #HeretoHELP

During COVID, a lot has changed. A couple of new services that we added and now offer are complimentary virtual inspections and virtual access to the loss.

By using Matterport’s specialty cameras we can take 360* scans so that anyone like insurance claim adjusters, managers, or property owners can view super detailed 3D images even if they reside out of state. We are excited about this technology because this assists us in engaging so much better with our clients since this feature provides round-the-clock access to the scanned property. The Matterport system enables us to generate self-guided tours as if you are getting a bird’s eye view and walking throughout the home or business. This allows first-hand viewing of the damaged areas and how extensive the scope of work will be due to water damage, fire damage, vandalism, or mold damage.

PART 3 - How to use a Fire Extinguisher?

5/4/2021 (Permalink)

Call our team in after the flames are out to help remove the lingering smoke smell and soot particles. We are ready around the clock!

Call our team in after the flames are out to help remove the lingering smoke smell and soot particles. We are ready around the clock!

Fire extinguishers can save lives and prevent the total destruction of properties. When a fire begins, how quickly it will spread depends on surrounding building and content materials. Everything can happen so fast that in that exact moment, it may be difficult to think clearly, let alone decide how to best react to the situation.

Knowing how to use a fire extinguisher can be of great value. Understanding how to actually use an extinguisher is the third step.

UNDERSTAND HOW TO USE A FIRE EXTINGUISHER

FEMA’s website under fire prevention recommends remembering the acronym PASS

Pull the extinguisher pin

Aim the nozzle low at the base of the flames. This is super important; otherwise, you could be wasting the canister contents

Squeeze the lever

Sweep the nozzle back and forth from side-to-side

(To be continued...)

Is your business and home adequately covered for a natural disaster?

4/29/2021 (Permalink)

Utilize your best defense to ensure that you are properly covered for each type of natural disaster that our sunshine state is prone to.

Utilize your best defense to ensure that you are properly covered for each type of natural disaster that our sunshine state is prone to.

Since 2020 was such a rough year, one takeaway that we have learned is that we can never over-prepare for the unexpected. None of us could have predicted the far-reaching and serious effects of the COVID-19 pandemic. Despite year after year of emergency preparedness reminders, many of us were still caught off guard. Even if our emergency supplies and food held up, we always need to update, restock, and replace expired or used items. In California, we need to think in terms of earthquakes, floods, windstorms, and wildfires.

What about properly preparing for your business? How is your commercial insurance policy written? If improvements have been made at the property, or specialty equipment is purchased… have photographic documentation been provided to your insurance? These important updates are crucial in the event of any sort of disaster from fire, storm, or flooding. Any sort of severe wildfire or storm can be catastrophic to a company if underinsured. Is coverage extended to include your contents? Or is coverage for the structure only? Have you researched separate Earthquake policies and coverage? Now is the time to reach out to your insurance agent, review policy limits, conditions, ensure your coverage is sufficient for your needs, and ask lots of questions. Find out specifics and if different types of disasters affect your deductible. Be smart and careful not to decline an increase in coverage that you may need in the event of a natural disaster.

Underwriting departments have periodic changes made from the Insurance commissioner’s board and regardless of being a long-term policyholder or a new one, changes are made across the board. Will those changes affect you and your livelihood? Many national insurance companies are no longer able to provide coverage for high-risk businesses or those located in fire danger zones or flood-prone areas in California. Finding wildfire coverage in Southern California may be a challenge for some, depending on the circumstances. Do your utmost each year to hope for the best but prepare for the worst.

How to minimize business disruption when dealing with unexpected damages

3/23/2021 (Permalink)

To support local businesses, rely on their field of expertise. With over a dozen years of restoration service experience, trust SERVPRO to help!

To support local businesses, rely on their field of expertise. With over a dozen years of restoration service experience, trust SERVPRO to help!

Small and large businesses alike have certainly felt the adverse effects of the 2020 Pandemic. And, while adjustments were made by most, the financial struggle may still continue to be felt.

Moving forward as each of us strives to support our local community and businesses the number one goal is to keep the doors of your establishment open. From time to time as employees are affected by COVID, to protect others, we still will see businesses forced to close temporarily since health is a priority. While some outbreaks are out of our control, the majority of us do our best to comply with the CDC’s business guidelines and standards to PLAN, PREPARE, and RESPOND. Closing the doors to disinfect and get your crew past the time frame of potential exposure may be very necessary but what about after a fire? Vandalism or flooding? Who can you hire to make immediate necessary repairs as quickly as possible to minimize downtime? Every moment closed is costing the business big time.

A reputable restoration company is SERVPRO of West Covina. Online reviews speak for themselves and tell quite a lot about who you can trust in an emergency situation. Call today and see why our team has five-star reviews on the top three major social media platforms: Facebook, Yelp, and Google. Let us support you and your business by providing helpful services in your time of need.

Well prepared businesses endure property damages

3/11/2021 (Permalink)

Don't go it alone, trust the experts!

Don't go it alone, trust the experts!

2020 was definitely a rough year for everyone. Businesses suffered, so we aim to help one another by supporting local businesses in our community. As we continue to move forward, it is vitally important to be well prepared for emergencies that could arise. An area not often thought of until after is regarding property damages that could occur. One strong wind or hail storm can damage a roof and allow for water intrusion. One water pipe suddenly busting can flood a floor and damage costly electronics. An electrical fire could cause irreversible injuries or structural damages so before it is too late, prepare now.

Statistics say that forty to fifty percent of businesses who sustain damages either due to fire, vandalism or water, cannot recover. By having an emergency plan AND a go-to professional company that you can trust to be there in your time of need, could make all the difference between having to close your doors permanently or simply addressing the issues quickly, and then reopening.

When selecting a restoration vendor, online reviews can tell you a lot about a company. How management responds to negative reviews when customers voice their concerns are important to consider when selecting a vendor for restoration needs. At SERVPRO of West Covina, our customers are highly valued and when the need arises, and they call us out to help yet again, it speaks volumes. You can trust our team to help out immediately because we truly care.

Unexpected damages can occur at any time so keep our number handy, enter it in your cell phone contacts and know that no matter the day nor hour, professional help is not far off.

Business Owners Can Be Proactive by Hiring Professionals

5/5/2020 (Permalink)

Here to generously help our community however we can... fire, water or another property emergency. Ready to rescue around the clock!

Here to generously help our community however we can... fire, water or another property emergency. Ready to rescue around the clock!

Serving West Covina and surrounding SOCAL cities

With over eighteen hundred SERVPRO franchises throughout the U.S. and Canada, we are doing our share in helping to contain this worldwide pandemic. We provide property damage restoration and disinfecting services for commercial properties and local businesses. Our goal is to assist in mitigating the impact of the coronavirus to our surrounding neighborhoods and cities. In March, one of the first well-known group cases of COVID-19 was in Kirkland, Washington. The virus outbreak and death toll at the nursing facility caught attention from the nation and our SERVPRO Disaster Recovery Team was called in for a professional thorough cleaning. By utilizing the experts for such an undertaking, no doubt much relief was provided to the community, staff, patients, as well as their families.

Our national disaster team is one of our biggest resources as they can be called upon and activated for any large loss whether due to the coronavirus, extensive flooding, water damage, wildfires, storm damages, or other biohazards cleanup needs. No job is too large for our elite large-loss specialists and will be supervised by a commercial operations manager to ensure timely mitigation with first-rate communication. Each independent franchise has access to our SERVPRO large loss disaster team to ease the minds of our national clients in the commercial industry. So property managers, city, county, and court buildings, hospitals, universities, and retail malls can continue to utilize SERVPRO of West Covina as their ‘go-to vendor’ in the event of a massive catastrophe.

Your commercial property’s appearance leaves a lasting impression on your clients and customers. Our SERVPRO of West Covina team is ready to assist with preventive or post-contamination measures. Now that we are dealing with COVID-19 it is imperative to be proactive now before lockdowns fully lift by bringing in the professionals for a good deep cleaning. After each professional cleaning, you have the option of posting documentation of the date of sanitization by our certified techs. As businesses begin to open and operate, have in place a plan for regular disinfecting through SERVPRO for preventative measures. Download for free the BE READY app on your mobile device and at the top corner, if you are in the SOCAL community… enter in SERVPRO of West Covina as your preferred franchise.

Concerns about indoor-air quality at your West Covina business?

4/25/2020 (Permalink)

Call and order the professional cleaning services that your Socal company could benefit from most!

Call and order the professional cleaning services that your Socal company could benefit from most!

Air Duct Cleaning Services

Since spring is here, you may want to consider having your air ducts professionally cleaned as a part of your annual ‘spring cleaning’. If you have an older building structure you may want to consider freshening up your air-ducts. Or if your property has undergone a remodel recently, post-construction can leave everything covered in a blanket of dust. Installing any sort of materials where machine cutting is done on the premises, can leave sawdust or tile dust that spreads everywhere within the property, even if the cutting is done outside, construction dirt always manages to find its way in. Sanding or woodwork projects such as installation of new cabinets, moldings, baseboards, trim, wood floors, engineered wood flooring, laminate, or tile-work could leave dust and debris behind thus making cleanup may necessary.

If your property has experienced water damage due to a water leak that was ongoing and perhaps went undetected for a time, such as leaks coming from the air-conditioning unit or a roof leak, could allow for HVAC vents to acquire a build-up of contaminants and possibly even mold. We strongly recommend Duct Cleaning after a Mold Remediation project. Part of our restoration process during a fire or smoke cleaning might include a thorough Air Duct Cleaning since soot particles could have easily scattered inside the building's ductwork. We also highly recommend Duct Cleaning after addressing an infestation issue. A pest invasion in an attic, within the dwelling or in a crawlspace could be problematic as dust particles aerosolize. Beware of health dangers related to vermin, insects, rodents, or their droppings being present indoors.

Air Duct Cleaning can be a proactive approach to healthy indoor air quality issues. For offices where desks are directly under a building vent and sickness or allergies are an ongoing problem, schedule an inspection to determine if an issue can be discovered. Addressing any discovered issue and scheduling regular air-system cleaning as regular maintenance could aid in the improvement air quality.

Regularly change air filters

Frequently replacing air filters is a good way to keep dust, most allergens, and particles at bay. Most filters should be replaced every few months depending on how dusty your area is.

The EPA recommends air duct cleaning when the following issues are discovered:

- Visible mold growth or painted area inside, where a previous tenant or maintenance person might have been trying to cover up an issue

- Infestation of rodents, vermin or insects

- Considerable deposits of clogging debris

Could Mold be an issue?

If you have an old leak, suspect possible mold growth, smell continuous musty odors, or are seeing visible signs such as spots or patches of mold or mildew, contact us today.

COVID -19 Accommodations

If someone passing through your establishment was confirmed or suspected to have the coronavirus, as a preventative measure, call for our disinfecting services. You can trust SERVPRO of West Covina as all of our technicians wear proper PPE for both their protection and yours. Ask to include our HVAC cleaning services as part of your property cleaning.

For HVAC cleaning at your business or home, count how many vent-registers are in the unit and call to get the cleaning scheduled.

Due to COVID-19, we are now offering virtual inspections so call to schedule yours today.

The High Standards -- Our Commercial Customers Can Expect

4/22/2020 (Permalink)

You are the best. So only hire the very best. We are so proud of our amazing team who has faithfully served our SOCAL Community for well over a decade

You are the best. So only hire the very best. We are so proud of our amazing team who has faithfully served our SOCAL Community for well over a decade

Our team can help you quickly resolve your emergency property damage problems!

Property damages come up unexpectedly so it’s a good idea to keep the contact info for our team set on your cell phone for the quickest possible access. The first 24 hours following a major loss are the most important in preventing secondary damages. By setting us in your list of contacts as follows, we will remain at the top of your contact list:

(first name) All Emergency Cleaning

(last name) SERVPRO of West Covina

(company) available 24/7 – servicing Socal

(+add phone) 626-960-9145

(+ texting phone) 626-807-9286

(+add email) SERVPRO9671@gmail.com

(+ url homepage) https://www.SERVPROwestcovina.com/

(+ url home) https://www.yelp.com/biz/SERVPRO-of-west-covina-west-covina-2

(notes) Specialty Cleaning & Disinfecting for: Water Damage. Fire. Smoke & Soot. Mold. Trauma. Crime Scene. Vandalism. Biohazard. Coronavirus.

Disasters can be devastating but to our SERVPRO team, it’s what we do each day. This is our specialty. We provide state-of-the-art service to business owners and property managers that are in need of immediate repairs by restoration experts. By calling our SERVPRO Team as soon as possible, we can communicate the scope of damages and start the mitigation process.

Here is what you can expect when SERVPRO of West Covina arrives at your business.

Initial INSPECTION

Immediately after receiving the loss notification, our SERVPRO of West Covina restoration professionals will be on-site to help ensure property damages are handled in accordance with the Institute of Inspection Cleaning and Restoration Certification (IICRC) Standards. Our team will inspect the affected areas to determine the scope and extent of damages. We will communicate and review our findings and recommended protocol with you, answering any questions before beginning the restoration process.

EMERGENCY Services

By hiring our IICRC Certified team, be assured that we will take the necessary steps to help protect your business or that of your commercial tenant, as well as personal property and other contents from further damage by acting quickly. Once the area is prepared for services, our technicians will begin the cleanup based on the need. We can assist with filing an insurance claim, should you decide to file a claim based on the circumstance. SERVPRO is a preferred service provider for most major insurance companies such as State Farm, Mercury, Farmers, AAA, Allstate, Nationwide, and many more. In addition, we have multiple National Commercial Accounts so we strive to develop and maintain business to business relationships. We are here to support your business’ growth by being a reliable and trustworthy vendor. Our goal is to always keep a fantastic working relationship with our local Insurance Adjusters, Claims Agents, Property managers and Business Owners because we understand that our reputation will always speak for itself.

Daily MONITORING

If water damage is the issue that we get called in for, to help ensure the structure and contents of your business is dried to the appropriate IICRC Standards. Our water technician will monitor and document the drying process. Continuous monitoring allows for the specialty drying equipment to be adjusted or reduced as needed to dry the area efficiently and cost effectively. The length of drying depends on how much water flooded throughout, how saturated, and type of materials that were affected. The daily documentation and updates of temperature & moisture readings will be communicated with your Insurance Company so that they are kept in the loop.

CONSTRUCTION Services

Our team has the ability to make structural repairs, replace building materials and reinstall cabinets & flooring. A final walk through of the property will be conducted with you to ensure your unit was returned to its preloss condition. Hiring SERVPRO of West Covina for your property damage needs leaves you in good hands as we have only your very best interest at heart.

A Note To Our Commercial Customers

4/20/2020 (Permalink)

Always compare apples to apples. Read the details & fine print to understand exactly what specific services you are choosing from.

Always compare apples to apples. Read the details & fine print to understand exactly what specific services you are choosing from.

With great optimism, we trust you are staying safe during this pandemic. We realize the huge toll COVID-19 is taking on everyone’s lives and businesses. Our business is handling all sorts of property damage cleanup & restoration. We offer services for trauma cleaning and biohazard removal, which has a similar protocol set out by the Center of Disease Control’s for virus cleaning. As a professional cleaning company, we are in an exceptional situation to assist those in need of commercial disinfecting for the coronavirus.

At this time many business owners and property managers are preparing by scheduling professional deep cleanings of areas where a fresh start is needed, or perhaps a potentially sick person briefly was in. Offices, call centers, warehouses, retail and service centers are requesting services now so that when the lock-down restrictions are lifted, businesses can safely reopen with the confidence that preventative measures have been taken.

By hiring SERVPRO for specialty cleaning your employees will feel more secure about returning to work because our service options for coronavirus cleaning goes beyond the average janitorial duties. Service options will range depending on your specific needs, various scopes and of course budget. From years of experience, our best advice is that you compare apples to apples. If company A provides pricing for well-trained technicians wearing full PPE to thermal fog an entire facility, floor to ceiling and everything in between with an EPA approved product vs. company B is pricing for a hand cleaning using their concoction for a (read the fine print) twelve foot section of doorknobs and desks only, you cannot compare the two estimates. It is important to convey your needs and main concerns to your contractor so that your requirements are understood and properly addressed. Know exactly what is included in your price estimate so that you can discern precisely what cleaning services you are receiving.

By making the best possible choice in your vendor selection, will make your business standout and shine. SERVPRO of West Covina is the perfect choice if you are in the SOCAL vicinity and rest assured that we are here to help with any emergency around the clock. – 626.960.9145

Deep Cleaning Services for Commercial Properties

3/24/2020 (Permalink)

Only hire professionals who hold the highest reputation in our SOCAL community. Our YELP page proves we are a fantastic choice!

Only hire professionals who hold the highest reputation in our SOCAL community. Our YELP page proves we are a fantastic choice!

Now is the best time to consider hiring a Professional Restoration Company for all specialty cleaning needs. With the outbreak of the Coronavirus, try as we may, none of us can say that we are fully one hundred percent confident that we clean often enough, long enough or thoroughly enough. When considering who to hire, please, please, please be cautious because sad to say some people are here to cash in on the misfortune of others. Some overcharge, some are not using the right products designed to combat the virus, but worse yet some do not know what they are doing, and you might end up right back where you started. Make your time and money count.

Take Proactive cleaning precautions

- Schools & Day-cares

- Hospitals

- Medical Offices

- Retailers

- Small Office Buildings

- Commercial Offices

- Apartment Buildings

- Residential Lobbies

- Restaurants

- Hotels, Motels & Airbnb’s

- Public & Common Areas

- Manufacturing & Industrial Plants

With over ten years of experience, multiple industry-standard certifications and as a General Contractor, you can trust SERVPRO of West Covina during this challenging L.A. quarantine. Please take a moment to learn why people love Ryan and our whole team on YELP or call now to inquire further.

Fire sprinkler leak? Call the experienced professionals at SERVPRO of West Covina

2/27/2020 (Permalink)

The safety of fire sprinklers when a fire erupts is priceless. Sometimes though water leaks or flooding can occur. We are here to help!

The safety of fire sprinklers when a fire erupts is priceless. Sometimes though water leaks or flooding can occur. We are here to help!

Since 2011 the state of California has required all newly constructed residential dwellings to have automatic fire sprinkler system installed. Fortunately the statistics show that having this safety feature reduces the risk of death in a fire by approximately eighty percent! Clearly, fire sprinklers are worth the expense and maintenance. This life saving preventative measure, while reducing property damage if a fire erupts, can at the same time hold the minuscule risk of causing water damage just like any other plumbing.

Over the years we have witnessed a few sprinkler leaks and flooding situations both in residential and commercial facilities. One of our small water leak cleanups due to a fire sprinkler system was in a one year old tri-level condo. This one occurred because the pressurized water lines created a stress on a weakened area of the sprinkler line and a pin-hole leak manifest on the pipe inside the wall in a third floor bedroom.

Just this month a medium sized commercial loss occurs at a retail store that was doing some construction and a piece of machinery accidentally hit a fire sprinkler. This caused a rupture that got our team out of bed at five A.M. to help out and begin an extraction of the flooded areas. Another leak occurred in a SOCAL home where a sprinkler line randomly dispersed water in a living room and poured out the front door into their yard.

A different homeowner was forced to learn a hard lesson, but hopefully all of us can learn from it. He hired a handyman to install a ceiling fan in his upstairs bedroom. The day of installation the handyman was up the ladder and pulled the cap off from what he thought was electrical wiring but turned out to be a fire sprinkler head. Water gushed at a high force raining onto all of the contents in the room. The handyman turned and said: “I am not licensed, nor insured. Do not call me again” and exited the premises never to be seen again. The devastated homeowner made every attempt to stop the water as it continued to flow down his laminate staircase and through his first floor. Unsuccessful, he called for help. The water continued to rush through his home until the fire department turned the street main valve off. Our SERVPRO of West Covina team helped this family get all the wet materials cleaned up and dried but what a stressful ordeal to go through. Down side is once any sort of laminate furniture or laminate floors get wet, they swell and need to be discarded, which costs.

Accidents are going to happen but as homeowners we can do our best to stay on well informed and educated so that when the unexpected occurs, we know exactly who to trust and rely on.

Businesses experience property damages too...

5/3/2019 (Permalink)

This is a snapshot of inside the ceiling after the discovery of a leaking sprinkler head. Cleaning this up quick is a wise choice. #commercialcleanup

This is a snapshot of inside the ceiling after the discovery of a leaking sprinkler head. Cleaning this up quick is a wise choice. #commercialcleanup

Being business owners ourselves, we are all too familiar of the day to day expenditures and how quickly they add up each month. The larger your business grows, the larger the monthly break-even point climbs. Between the insurances necessary, building lease, training, payroll and product expenses, the dollar amounts are constantly climbing. Even though we wisely plan for the unexpected, when property damages do occur not only is the disruption a challenge in the day to day function but also the related costs can get ridiculously high.

Sometimes old plumbing is to blame for leaks or sudden pipe bursts, other times the hot water heater has run its life course and other times human error is to blame and toilets may overflow. Fire sprinklers can spring pinhole leaks or suddenly burst as well. In the past, we have even seen a handyman mistaken a sprinkler for an electrical connector thinking it was the hookups for installing a ceiling fan. This line under pressure water poured out until the water turn off could be reached.

Costs for repairs can continue to rise when water is involved because if unnoticed or left untreated the bacteria levels in the water will multiply and within a short time cause mold to grow. The mold will thrive in the darkened damp area of a ceiling or wall cavity and spread to however far the water and organic materials like paper or wood keep it fed. Once we have experienced the whole water damage process we then understand the issues at hand and know better for next time, if a next time were to occur. As a business owner or property manager, part of being prepared for the next damage that may occur whether from rain or another water intrusion, is by finding a Restoration Company that you feel comfortable with, LIKE and can wholeheartedly trust.

Find out why so many of our customers are repeat customers. Meet our SERVPRO of West Covina team, they are the best! The picture posted here on this blog is just one damage that this local business has had occur. In total, they have called our SERVPRO of West Covina team out to their various properties over six different times. We are grateful for their consideration and repeat business for all of their home and business property cleanup needs.

Mold found at a Commercial property in Rancho

4/25/2019 (Permalink)

Look at what this Rancho property's maintenance person found behind paint and building supplies. Some mold needing to be safely removed...

Look at what this Rancho property's maintenance person found behind paint and building supplies. Some mold needing to be safely removed...

Being a preferred vendor for most national insurance and local property management companies we tend to be a first responder for water leaks or damages. Usually, the first call made once an issue is discovered is to either an agent or property manager then they call us for our free inspection and estimate. Even when one of our out of state investment properties flooded full of water, our very first call was to our property manager instructing them to please call the local SERVPRO because we wanted the cleanup and reconstruction handled properly.

A recent call that we got in regarding water leaking was from a commercial property manager in Rancho Cucamonga. The water leaks were affecting multiple businesses but all in one center. One was a pizza restaurant that was dealing with a mushy ceiling from what was thought at the time to be due to recent rains and the water damage it left behind. Another was a different eatery sharing a wall that was dealing with reoccurring water intrusion that resulted in mold. It is no fun dealing with mold whether it is in a residential or business setting because potential allergy and health concerns for everyone is the main concern. Sometimes the mold may not be visible but a damp musty smell is present. Other times such as in this circumstance the mold discovered was found upon opening the room as spots were speckled across the white drywall. The source of the leak was the first to be determined so as to make the needed plumbing repairs, then the removal of mold could proceed. If you are ever wondering about a moldy, odd or weird smell, give us a call. Mold removal is one of our specialties and our mold inspections are complimentary. Call anytime!

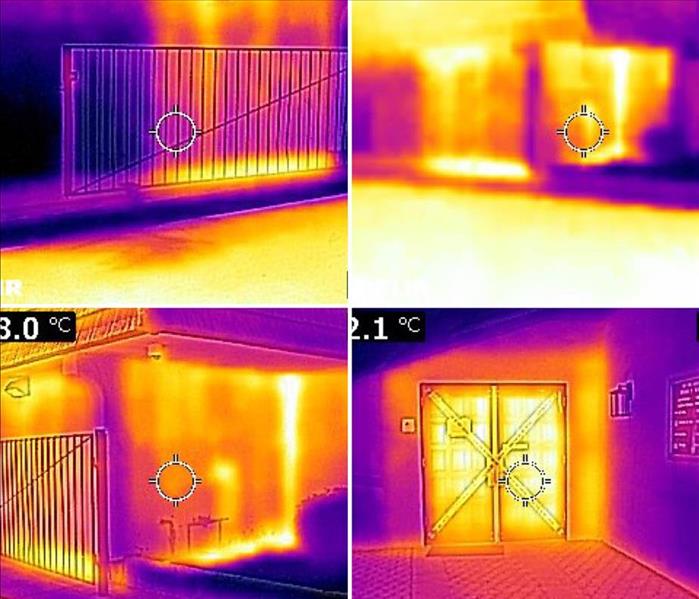

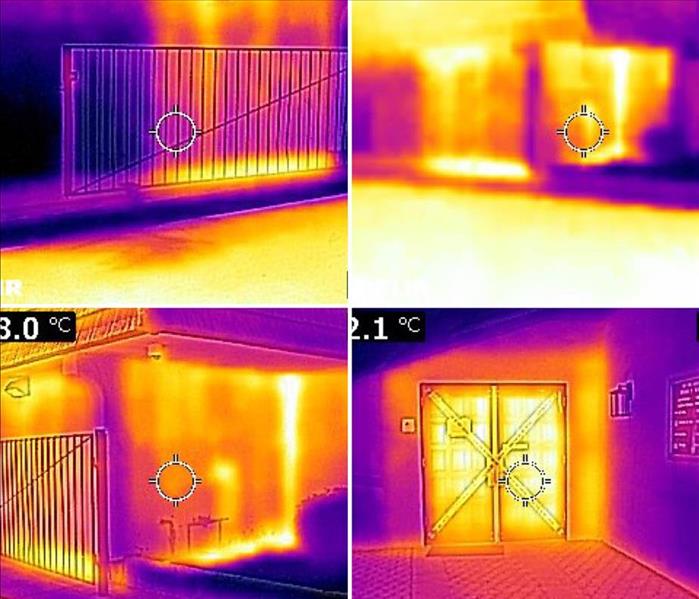

Water Damage at a Local Place of Worship in West Covina

4/24/2019 (Permalink)

Our infrared camera quickly pics up on water-saturated areas in this commercial building by reading & illuminating the colder temps in blue & purple.

Our infrared camera quickly pics up on water-saturated areas in this commercial building by reading & illuminating the colder temps in blue & purple.

Whenever a special event is coming up, much preparation, cleaning and hard work go into getting the facility ready. This past weekend in preparing for a very special event, a local place of worship accidentally left the water running in a planter in hopes of maximizing the landscape. Unfortunately, the water ran all night and the next day flooding had occurred on the inside of the building since the water soaked into the building materials.

One of our specialty pieces of equipment to detect temperature variances and how far the water has traveled is an infrared camera. Note the images posted as they show the high heat radiating from inside the building. The heat is amped up by specialty equipment to dry the structure completely and as fast as possible to get the building back into working order as soon as it is feasible. Because this was a commercial building, time was of the essence. We love this camera because it can show hot and cold temperatures inside a wall. In most cases, this aids our water technicians being able to thoroughly map out the path the water took and develop the most effective water damage cleanup plan of action for drying out the structure.

Time is Money

4/23/2019 (Permalink)

Save time & money. Hire SERVPRO of West Covina for all your Commercial Cleaning needs. Ready to rescue 24/7!

Save time & money. Hire SERVPRO of West Covina for all your Commercial Cleaning needs. Ready to rescue 24/7!

Businesses whether retail, office, school or industrial companies alike, all know that time equals money. So when a commercial property suddenly is faced with fire or water damage, taking action to resolve the problem both the proper way and quickly is crucial. Every moment the day to day operations are down is costly. As a professional restoration team who works closely with national insurances, local businesses and property management companies, we know they all have the goal of keeping costs to a minimum. So, we work extremely hard to be efficient at what we do from the beginning to end of each and every loss.

If flooding has occurred, safety is always first. Beware of slips, falls and potential risks of electrical shock. Will you need water extraction or pump out, help with protecting and salvaging items and equipment around the affected areas and professional structural drying to avoid potential mold issues? If a fire occurred, is everyone safe? To keep from injury and to prevent further damages, keep the burned and smoky areas clear of foot traffic and from being touched. Do you need help with inventorying items lost in the blaze, removal of soot and smoke odor? Will construction services be needed? Has water damages occurred from extinguishing the flames? SERVPRO can help with all of the above.

By responding immediately and with the appropriately sized team for the cleanup situation, we help to meet the goal of saving time and money. Many times our teams work around the clock in shifts to proceed with the commercial restoration process in a suitable manner. We understand each day the business doors stay closed, money is not being generated as it should. We know that if the facility is a restaurant, grocery store or food manufacturer, not until the damaged space is returned to a safe and sterile environment, will the California Department of Public Health and Safety will be able to give their clearance to reopen. This will ensure the safety of the business’s environment. Our recommendation? Only use a professional restoration company that has well trained IICRC Certified team members along with a fine reputation for doing quality work in the community. One that has a General Contractor’s license and is familiar with California state guidelines, building codes and reducing costs ultimately saving you both time and money.

West Covina Commercial Water Damage

4/24/2018 (Permalink)

Call our SERVPRO of West Covina Team 24/7. 626.960.9145

Call our SERVPRO of West Covina Team 24/7. 626.960.9145

We have our teams on stand-by around the clock… so when the water leak or flood calls pour in, we respond with excitement to help by responding quickly. Any business having to deal with down time is losing money so our goal is to get you back, up and running as soon as possible. Sometimes it means working long hours or through the night but we are dedicated and always happy to do so.

Responding to a toilet overflow (from the tank resevore - clean water), we are never quite sure as to the extent of the damage until we walk the building site. In this instance, the water from the toilet ran all night long and poured out amongst all the offices. So, in the morning, when the first office worker opened the front door, she was surprised to find objects floating all around in several inches of water. It was decided to call the closest SERVPRO. Fortunately that was us at SERVPRO of West Covina, so ten minutes later, the very first thing our water technician did was turn the water main off, then got right to work by extracting the standing water and placing drying equipment to dry out the multiple offices.

Despite the temporary interruption, the business owner was super appreciative to our entire team and pledged that we have a customer for life. We love helping to support our local community businesses!

Chino Hills Pot / Marijuana House Cleaning

4/12/2018 (Permalink)

Local landlord discovers renters were using their rental home for growing marijuana. Lots of damage resulted.

Local landlord discovers renters were using their rental home for growing marijuana. Lots of damage resulted.

First thing this morning, we sent one of our inspection crews out to Chino Hills for a ‘pot house cleaning’ and mold issue. From time to time, our team receives such calls to inspect houses or even commercial buildings that have been discovered to have been taken over by a secret marijuana grower. We have been called out for large single dwelling homes, multiple jumbo homes in a single block and commercial warehouses and buildings, all of which were completely covered with mold. Our inspections discover boarded up windows, growing stations, potted plants and typically mold everywhere on all walls and ceilings from the moist damp conditions. Truly a property owner’s nightmare, but they are always appreciative that we are there to help return the property back to livable and rentable conditions ASAP.

Our specialty cleaning & mold removal professionals are very detailed and thorough. Any standard visual inspection is complimentary. Call our office for any specialty cleaning needs, even unusual ones like uncovering a marijuana-filled room or building…

Water Leaks & Plumbing Issues… is it simply enough to get them repaired?

4/3/2018 (Permalink)

Water extraction needed in this Covina Office, then the dry out of the structure, office furniture and supplies could begin…

Water extraction needed in this Covina Office, then the dry out of the structure, office furniture and supplies could begin…

We place great value in the money invested in our Commercial and Residential properties. When it comes to maintenance, we work hard to stay on top of the problems so they do not quickly multiply. It is wise to fix water leaks from dripping faucets right away to preserve our water supply. Such leaks from plumbing fixtures/fittings or pipes sometimes are apparent and visible but unfortunately many are hidden and may go undetected causing rot and costly damages.

Many at first think that mopping up visible water is all that is needed, but some may fail to realize that a lot of times, water quickly travels into the carpet or floor padding, past baseboards, to walls and beyond.

The detection of water behind these areas requires professional equipment. This should be taken seriously because left ignored the damaged surfaces can develop mold which thrives in moist dark areas such as behind walls, cabinets or under flooring, all in the matter of days or even hours.

To avoid missing crucial cleaning steps, utilize a water damage professional with proper IICRC training.

In the SOCAL area? Local property management companies love us for our immediate response. Call to ask about our complimentary inspections 1.877.469.7776

For around-the-clock emergency property assistance call on the trusted SERVPRO name with a team who cares about helping restore everything quickly.

For around-the-clock emergency property assistance call on the trusted SERVPRO name with a team who cares about helping restore everything quickly.

24/7 Emergency Service

24/7 Emergency Service